Maastricht Update – launch

We decided to provide indication on how the CEECs perform according to the EMU entry criteria laid down in the Treaty of Maastricht which entered into force on 1/11/1993. The idea is the indicators to be regular (for instance monthly) – but lets see how it works ;)

The Maastricht Criteria:

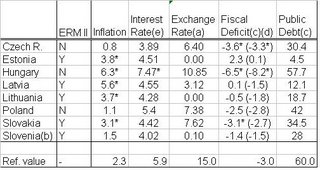

Inflation – annual inflation (of CPI) rate no higher than the average inflation rate in 3 EU Member States with the lowest inflation + 1.5% points;

Interest Rate – long-term interest rate (10 year government bond rate) no higher than average of interest rates in 3 EU member states with the lowest inflation +2% points;

Exchange Rate – (against euro) for two years to remain within +/-15% of the pre-established central rate;

Fiscal deficit – of general government not higher than 3% of GDP*;

Public debt – not higher than 60% of GDP*;

*some additional relaxing provisions apply.

The Maastricht Update:

Sources: Eurostat , ECB , EBRD Transition Report 2006 .

Note: * - currently not fulfilling MC; (a) Exchange rate criterion value calculated as maximum deviation (+ or -) of the daily exchange rate from reference value in the last two years. The reference value is in case of ERM II countries the central rate, while in the remaining countries it is a two year average of the daily exchange rate from today-2year to today.

(b) The decision for Slovenia to enter the EMU was already made, so its performance is just for comparative reasons; (d) value for 2005 – this value is not available monthly; (d) Brackets contain forecasts for 2006 from the EBRD Transition Report 2006. Methodological discrepancies between national authorities and Eurostat in case of Hungary and Poland; (e) ECB on Estonia: The current indicator represents the interest rates on new EEK-denominated loans to non-financial corporations and households with maturities over five years. However, a large part of the underlying claims is linked to variable interest rates and the claims are subject to a different credit risk than government bonds.

1 Comments:

Many of reforms in Poland have been moved, which should be applied in 2006. Just now 2009 is absolutly wrong year for any - so next months/year Polish zloty will be WEAKER than just now - and will oscilate around 5 PLN for 1 EUR.

High inflation, rapidly going down industrial production, high unemployment rate (april 2009 close to 15 % !!!).

Post a Comment

<< Home